Key Takeaways: Maintaining a firm grip on your business finances can feel intimidating, especially if you’re new to entrepreneurship. Perhaps you started your company because you’re passionate about a product or service not because you love spreadsheets. Yet financial literacy is a cornerstone of success. In fact, studies have found that 82% of business failures […]

Running a small business in Toronto means juggling taxes, invoices, and cash flow in one of Canada’s busiest markets. It’s a lot to handle, and the right accounting software can make it much easier. In fact, poor financial management especially cash flow problems causes about 82% of small business failures, and around 61% of Canadian […]

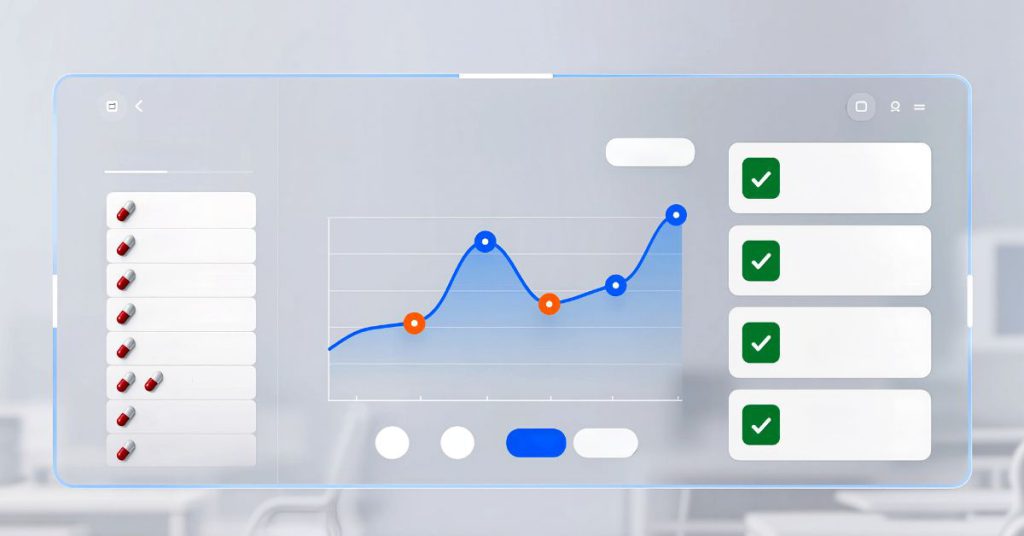

Seasonal cash-flow dips are one of those problems founders feel long before they see them on a report. Holiday inventory, slow summers, tax months, weather, grant cycles, all pulling cash in different directions. Now that AI tools forecast seasonal cash-flow dips with more speed and detail, many teams wonder if this is real help or […]

If you run a small business in Canada, cash flow probably keeps you up more than profit does. Invoices look good on paper, but money hits the bank late. Subscriptions pull funds at random times. Tax installments show up just when you feel you are catching up. You might feel that only an accountant can […]

For a lot of Canadian owners, card fees feel like a quiet tax on every sale. You look at your statement, see 2 or 3 percent shaved off the top, plus a list of extra charges, and you wonder if there is any fair way to bring that number down. The short answer is yes, […]

For many Canadian owners, payments feel like a tradeoff. You want to get paid fast, keep customers happy, stay safe from fraud, and keep fees under control. That mix is not easy, especially with more scams, chargebacks, and new digital options showing up each year. Recent data from the Canadian Federation of Independent Business and […]

For a small or mid-sized business in Canada, cash flow often feels very close to the real scorecard. Sales can look fine on paper, yet money hits your bank late, card fees eat into margins, and reserves or chargebacks show up at the worst time. So the question many owners raise quietly is simple: If […]

Payment systems have a habit of being set once and then ignored. The terminal works, invoices go out, money comes in so everything seems fine. Until you see unexpected fees on your statement. or a rise in chargebacks or more customers asking for payment options you don’t offer. That’s why every small business needs a […]

If you run a small or mid-sized business in Canada, you hear the terms (Interac, EFT, and credit-card payments)a lot. They show up on processor quotes, bank pages, and cash flow reports. Yet many owners still feel unsure which one actually helps their business day to day. Fees seem vague. Timing feels unclear. And every […]

If you run a small or mid-sized business in Canada, you have probably seen this scene at your checkout: Customer taps their phone on the terminal, waits half a second, then asks, “Oh, you don’t take Apple Pay?” In that small moment, you face a decision. You can ask them to pull out a plastic […]